January 20, 2022

Texas Home Equity Lending Rule Changes, CFPB: Seven Examples of Unfair Practices and Violations in Mortgage Servicing, and more!

Read more below!

Texas Home Equity Lending Rule Changes

The Finance Commission of Texas and the Texas Credit Union Commission (the “Agencies”) recently adopted amendments to the home equity lending rules in the Texas Administrative Code. These amendments primarily provide clarification regarding electronic delivery and signing of home equity applications and disclosures. They also clarify the definition of “bank, savings and loan association, savings bank, or credit union” for purposes of the rules, as well as:

- add definitions and statutory citations for the terms "E-Sign Act" and "UETA” in §153.1.

- amend the title to §153.5 to conform to letter case conventions that are used in other rules and renumber references to §153.1 that changed because of the added definitions.

- amend §153.12 to explain that a loan application may be submitted electronically in accordance with state and federal law governing electronic disclosures, with references to UETA and E-Sign Act.

- amend §153.13 to state that the lender may provide the preclosing disclosure electronically in accordance with state and federal law governing electronic disclosures.

- adopt new §153.17(2) to specify that for purposes of Section 50(a)(6)(P), a "bank, savings and loan association, savings bank, or credit union doing business under the laws of this state or the United States" includes a financial institution that is chartered under the laws of another state and does business in Texas in accordance with applicable state law.

- adopt new §153.26(4) to explain that the owner and lender may sign the written acknowledgment of fair market value electronically in accordance with state and federal law governing electronic signatures and delivery of electronic documents.

- adopt new §153.45(E) to explain that, for a rate/term refinance of a home equity loan, the lender may provide the refinance disclosure electronically in accordance with state and federal law governing electronic signatures and delivery of electronic documents.

- adopt new §153.51(2) to explain that the lender may provide the 12-day home equity consumer disclosure electronically in accordance with state and federal law governing electronic signatures and delivery of electronic documents.

Note: These amendments confirm current practices and will not affect how home equity lending is handled in Texas. The Agencies are currently working on a change to the definition of “business day” under the rules to address the new Juneteenth federal holiday as well as an additional business day issue PPDocs alerted them about previously. The draft rules are currently in the pre-comment phase and, even if everything goes as planned, they will not be adopted before the Juneteenth holiday. We will provide more information as it is available.

CFPB: Seven Examples of Unfair Practices and Violations in Mortgage Servicing

In a blog post on December 9, 2021, the CFPB addressed certain unfair practices and violations of consumer protection laws the Bureau is noticing among mortgage servicers. The CFPB said (in pertinent part):

During the pandemic, we’ve closely monitored mortgage servicing companies as over 7 million homeowners entered forbearance programs to defer their monthly payments. A recent report revealed numerous violations of consumer protection laws, including those put in place to help families impacted by the financial crisis.

Due to the increase of homeowners needing assistance this year, the CFPB has prioritized supervision of mortgage servicers. A recent review of their 2021 supervision efforts revealed certain violations, including:

- Charging late or default-related fees to borrowers in CARES Act forbearance programs. The CARES Act generally prohibits a servicer of federally-backed mortgage loans from imposing these fees while a borrower’s mortgage payments are being deferred due to financial hardship caused by the COVID-19 emergency.

- Failing to end preauthorized electronic fund transfers. Otherwise known as EFTs, some servicers failed to end automatic electronic payments when an account had been closed, often resulting in additional and repeated fees when borrowers had insufficient funds in their banking account.

- Charging consumers unauthorized amounts. Our report found that, in some cases, mortgage servicers overcharged borrowers for services or added fees outside of their loan terms, including for home inspections and Broker Price Opinions.

- Misrepresenting mortgage loan transactions and payment history in online accounts. Examiners found that servicers provided inaccurate descriptions of payments and transaction information, which may have misled borrowers.

- Failing to review borrowers’ applications for loss mitigation options within 30 days. Examiners found that mortgage servicers violated Regulation X because the servicers didn’t evaluate the borrowers’ complete loss mitigation applications and provide a written notice stating the servicers’ determination of available options within 30 days of receiving borrowers’ applications.

- Incorrect handling of partial payments. Servicers are required to take one of the following specific actions when they receive a partial payment from a borrower: crediting the payment, returning it to the consumer, or holding it in an unapplied funds account. Examiners found that, in some cases, servicers put these payments in borrowers’ escrow accounts rather than returning the amount or crediting it to borrowers’ next monthly payment.

- Failing to automatically terminate Private Mortgage Insurance (PMI) on time. For borrowers with PMI, servicers are generally required to automatically terminate those additional PMI payments once the mortgage loan’s principal balance is first scheduled to reach 78 percent of the original value of the property. Examiners found that in many cases the servicers’ data was inaccurate, and the PMI was not terminated in a timely manner.

This blog post provides valuable insight to mortgage lenders and servicers on the CFPB’s current thinking regarding issues in mortgage servicing.

Note: Click on the link above to read the entire blog post and to access links within the blog.

FDIC Updates Technical Assistance Videos on Mortgage Servicing Rules

The FDIC released its update of the five technical assistance videos on the mortgage servicing rules. These videos incorporate the 2016 Mortgage Servicing Rule and the 2016 Fair Debt Collection and Practices Act Interpretive Rule and have been updated to match the FDIC’s modernized video style. The video series focuses on the small servicer as defined in Regulation Z; however, Video 3 provides an overview of some of the requirements for financial institutions that lose their small servicer status. The videos range in duration from around 8 to 27 minutes.

- Video 1 provides an overview of mortgage servicing and describes how to determine whether a servicer meets the definition of a small servicer under Regulation Z. (10:12)

- Video 2 describes key provisions for which small servicers do not have an exception. These are the provisions with which all servicers, small and large, must comply. (27:23)

- Video 3 provides an overview of some of the requirements that apply to large servicers and from which small servicers are exempt. This video is useful for large servicers. (12:08)

- Video 4 describes successors in interest, including the definition of successor in interest and a general overview of what to be aware of when working with successors in interest. (8:00)

- Video 5 provides information and examples related to developing a compliance management system that considers the mortgage servicing rules. (11:41)

Frequently Asked Question

Question: We are ordering borrower transcript information from the IRS using an IVES participant. Can you tell me how to order the form in your system?

Answer: On August 9, 2021, the IRS released a memo detailing changes to requirements of who must complete a 4506-C. Beginning January 1, 2022, the IRS required each borrower to complete a separate 4506-C for each tax form requested. Some investors and tax servicers communicated earlier mandatory compliance dates.

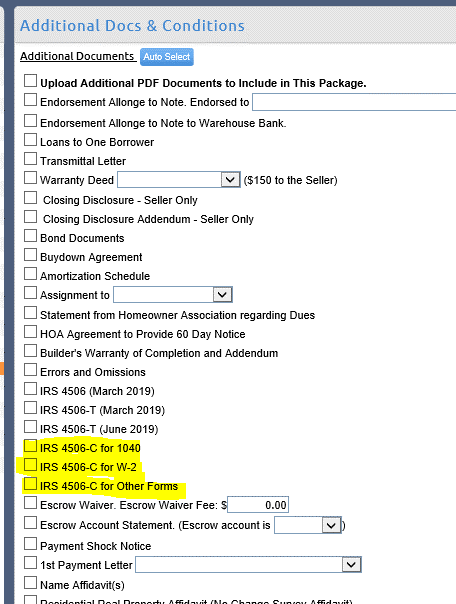

The Additional Docs & Conditions screen of the PPDocs order form allows the user to indicate whether they want a 4506-C for the W-2, 1040, or another tax form included in the closing document package. When there is more than one borrower, each borrower will have a separate 4506-C for the W-2 forms, although there may still be a combined 4506-C for the 1040 in cases where the borrowers file for their taxes jointly.

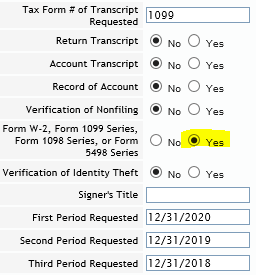

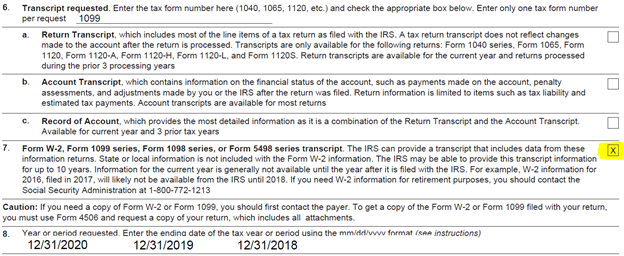

When “4506-C - Other” is chosen on the Additional Docs screen, there must be one tax form number entered in the IRS Details area of the Borrower screen. Please note that only the relevant tax years should be entered in the IRS Details, and there should be only one option selected on the 4506-C. A sample is provided below.