September 24, 2021

PPDocs System Tip: It’s Tax Paying Time, PPDocs System Tip: Did you know?, Electronic Document Delivery Basics and more!

Read more below!

PPDocs System Tip: It’s Tax Paying Time

Texas Property tax bills are delivered in October. If the current taxes due have been paid and the first payment date on the loan is prior to January 1, 2022, you’ll want to read our Tax Paying Time memorandum to learn how to handle tax escrows in our system.

PPDocs System Tip: Did you know?

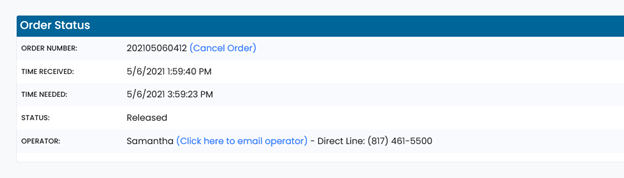

You can contact the operator that is working your file via email or by phone. You can find this information on the Order Status page. Here is an example:

Electronic Document Delivery Basics

Many lenders remain confused by electronic delivery of documents. To help lenders understand what is required, we created a memorandum. Here are some highlights:

• The applicant’s consent for electronic delivery must occur electronically.

• Documents will not be considered delivered until the applicant completes the E-Sign process.

• Once the applicant has completed the E‐SIGN agreement, then the agreement will cover any subsequently delivered documents.

• TRID requires the CD to be in the applicant’s hand at least 3 business days before closing. (Our memorandum details three ways this can happen.)

Our E-Sign Memorandum can be found here.

Frequently Asked Question

Question: We have a Texas Home Equity loan that we want to close on June 1, 2021. The rescission period goes through June 4, 2021, and the first payment will be August 1, 2021. I received an audit stating that the 1st payment is more than 60 days from the closing date. May the first payment be on August 1, 2021?

Answer: Under Texas law, the first payment date on a Texas Home Equity loan must be scheduled to be repaid “no later than two months from the date the extension of credit is made.” In the Texas Administrative Code (below), the “date the extension of credit is made” is defined as the date when the loan docs are signed, i.e., the date of closing. The Texas Administrative Code further states that the first payment must be scheduled to be repaid no later than the corresponding date in the second month succeeding the month of closing.

Because months vary in length, we created an audit warning that conservatively warns the user if the first payment date is more than 60 days from closing. If, for example, your is closing date (June 1, 2021) and your is first payment date (August 1, 2021), because both fall on the same day of the month and the month of your first payment date is the second succeeding month following the closing month, you have complied with Texas home equity requirements.

Accordingly, you may acknowledge that audit as your first payment conforms with Texas law.

Texas Administrative Code

| TITLE 7 | BANKING AND SECURITIES |

| PART 8 | JOINT FINANCIAL REGULATORY AGENCIES |

| CHAPTER 153 | HOME EQUITY LENDING |

| RULE §153.11 | Repayment Schedule: Section 50(a)(6)(L)(i) |

Unless an equity loan is a home equity line of credit under Section 50(t), the loan must be scheduled to be repaid in substantially equal successive periodic installments, not more often than every 14 days and not less often than monthly, beginning no later than two months from the date the extension of credit is made, each of which equals or exceeds the amount of accrued interest as of the date of the scheduled installment.

(1) The two month time period contained in Section 50(a)(6)(L)(i) begins on the date of closing

(2) For purposes of Section 50(a)(6)(L)(i), a month is the period from a date in a month to the corresponding date in the succeeding month. For example, if a home equity loan closes on March 1, the first installment must be due no later than May 1. If the succeeding month does not have a corresponding date, the period ends on the last day of the succeeding month. For example, if a home equity loan closes on July 31, the first installment must be due no later than September 30.