October 20, 2020

CFPB Provides RESPA Section 8 FAQs, CFPB Issues Assessment of TRID Rule and more!

Read more below!

CFPB Provides RESPA Section 8 FAQs

On October 7, 2020, the CFPB published guidance in the form of Frequently Asked Questions on the Real Estate Settlement Procedures Act (RESPA) Section 8 topics. The FAQs provide an overview of the provisions of RESPA Section 8 and respective Regulation X sections. Additionally, they address the application of certain provisions to common scenarios described in CFPB inquiries involving gifts and promotional activities, and marketing services agreements (MSAs).

The CFPB also determined that Compliance Bulletin 2015-05, RESPA Compliance and Marketing Services Agreements, does not provide the regulatory clarity needed on how to comply with RESPA and Regulation X and therefore is rescinding this bulletin. The Bureau’s rescission of the Bulletin does not mean that MSAs are per se or presumptively legal. Whether an MSA violates RESPA Section 8 will depend on specific facts and circumstances, including the details of how the MSA is structured and implemented. MSAs remain subject to scrutiny, and the CFPB stated that it remains committed to vigorous enforcement of RESPA Section 8.

You may access the FAQs here: https://www.consumerfinance.gov/policy-compliance/guidance/mortgage-resources/tila-respa-integrated-disclosures/tila-respa-integrated-disclosure-faqs/

- PPDocs Note: If you saved Compliance Bulletin 2015-05, rather than deleting it, we recommend you change the file name to include something like: “RESCINDED 10.2020.” Keep the bulletin with your RESPA Section 8 materials; it still applies to actions taken prior to its rescission. Add the FAQs to your RESPA Section 8 materials.

Staff Safety and Supply Chain Disruptions Are Mortgage Lenders’ Biggest Pandemic Challenges

On October 2, 2020, Fannie Mae released a report on the biggest challenges currently faced by mortgage lenders. The health and safety of staff, gaining clarification on loan eligibility and forbearance, and supply chain disruptions were the three biggest challenges cited by lenders and servicers in response to COVID-19. As the virus continues to disrupt business operations, lenders are prioritizing streamlining processes and optimizing consumer-facing technology to keep up with the evolving conditions.

You may access the report here: https://www.fanniemae.com/sites/g/files/koqyhd191/files/migrated-files/resources/file/research/mlss/pdf/mlss-q2-2020-covid-challenges.pdf

- PPDocs Note: To ensure that PPDocs does not pose a supply chain disruption threat to our clients, most staff members have been working remotely since late March/early April and are following recommended safety protocols when visits to the office are unavoidable.

CFPB Issues Assessment of TRID Rule

On October 1, 2020, the CFPB published a report containing the results of its assessment of the TRID Rule. Key findings include:

Borrower understanding of mortgage transactions has improved due to their receipt of the required disclosures.

Based on the industry surveys, a typical cost for a lender to implement the TRID Rule was $146 per mortgage originated in 2015, or roughly 2.0 percent of the average cost of originating a mortgage. Similarly, a typical cost for a closing company to implement the TRID Rule was $39 per closing in 2015, or about ten percent of the average cost of closing.

The TRID Rule’s effects on ongoing costs is less clear. Industry data indicate that mortgage lending costs have steadily increased over the past decade. However, the Bureau does not have any data that demonstrates how much, if any, of these increased costs are attributable to the TRID Rule.

The TRID Rule appears to have initially decreased mortgage originations and increased closing times, but these measures returned to pre-TRID Rule levels in a relatively short period of time.

You may access the report here: https://files.consumerfinance.gov/f/documents/cfpb_trid-rule-assessment_report.pdf

- PPDocs Note: Since the implementation of TRID, many lenders have turned to PPDocs for a cost-effective method of preparing and providing disclosures that comply with the TRID Rule. If you are not a full-service client or are not using PPDocs for all your consumer real estate lending document and disclosure needs, contact Client Relations to discuss how we can further assist: cr@ppdocs.com

October’s Frequently Asked Question

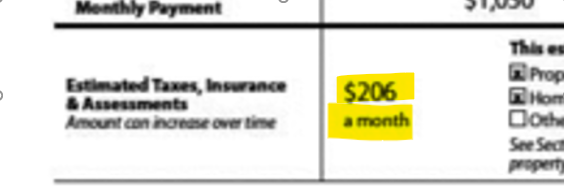

Question: Here are my escrow entries; however, I keep getting an error. Can you please help me with this?

Answer:

This time of year, escrow issues occur when paying property taxes because the next property tax payment is outside of the first twelve-month escrow analysis period. Please refer to our “TAX PAYING TIME (2020)” document for our recommendations on how to handle the escrow entries in this case.