September 22, 2020

Proposed Amendments to Texas Home Equity Interpretations Published, Annual TILA Threshold Adjustments and more!

Read more below!

Proposed Amendments to Texas Home Equity Interpretations Published

Last month, we reported that the Credit Union Commission and the Texas Finance Commission voted to propose amendments to the Texas home equity lending interpretations. The proposed amendments were published in the Texas Register on August 28, 2020. Our summary of the proposed amendments can be found in our August newsletter. The Credit Union Commission will consider adoption of the amendments at its meeting on November 11, 2020, and the Finance Commission will consider adoption on October 16, 2020.

Texas Joint Financial Regulatory Agencies Adopt Amendments to Payoff Statements for Home Loans

The administrative rules concerning requirements for the creation and delivery of payoff statements for home loans are contained in 7 TAC, Chapter 155. The Joint Financial Regulatory Agencies recently amended 7 TAC §155.2 to require that a payoff statement include the loan number assigned for identification purposes, or if the loan number is not available, the original loan amount. The remaining amendments to §155.2 are non-substantive.

Annual TILA Threshold Adjustments

On July 17, 2020, the CFPB issued a final rule amending the calculations of the dollar amounts for several provisions in Regulation Z. This final rule revises, as applicable, the dollar amounts for provisions implementing TILA and amendments to TILA, including under the Home Ownership and Equity Protection Act of 1994 (HOEPA) and The Dodd-Frank Act. The CFPB is adjusting these amounts, where appropriate, based on the annual percentage change reflected in the Consumer Price Index (CPI) in effect on June 1, 2020. This final rule is effective January 1, 2021.

For HOEPA loans, the adjusted total loan amount threshold for high-cost mortgages in 2021 will be $22,052. The adjusted points-and-fees dollar trigger for high-cost mortgages in 2021 will be $1,103. In other words, for loans of $22,052 or greater, the HOEPA fee threshold is 5% of the loan amount. For loans of less than $22,052, the HOEPA fee threshold is 8% of the total loan amount or $1,103, whichever is less.

For qualified mortgages, the maximum thresholds for total points and fees in 2021 will be:

- 3 percent of the total loan amount for a loan greater than or equal to $110,260;

- $3,308 for a loan amount greater than or equal to $66,156 but less than $110,260;

- 5 percent of the total loan amount for a loan greater than or equal to $22,052 but less than $66,156;

- $1,103 for a loan amount greater than or equal to $13,783 but less than $22,052; and

- 8 percent of the total loan amount for a loan amount less than $13,783.

September Frequently Asked Question

Question: We have a cost overrun on a Texas homestead construction loan. What are our options?

Answer:

There are three ways to go about increasing the mechanic’s lien contract (“MLC”) amount.

One option is to modify the MLC and Note/Deed of Trust to increase the contract and loan amount. Modifying the MLC and Note/Deed of Trust is particularly beneficial when you want to refinance into a secondary market permanent loan when construction is complete. If you keep it all in the same loan, then you can underwrite a secondary market perm refinance as a FNMA “limited cash out refinance”. The downside to modifying the first lien is that your title insurance policy will not cover the cost overruns, which can present significant risk if the cost overruns represent a large amount of money.

If you use a second lien to finance the cost overruns, the benefit is that you can get title insurance for the second lien and the amount financed for overruns will be insured. The downside is that if you want to refinance after completion into a secondary market loan, you would be rolling two liens into the refinance. Accordingly, you would have to underwrite the secondary market refinance loan as a FNMA “cash out refinance” because the second lien is not for purchase money, which may not be the greatest option for the borrower from a price standpoint.

If you do not intend to sell the permanent loan in the secondary market, then the FNMA underwriting issue loses its significance, and the issue of title insurance may become the primary consideration. If the cost overruns are a relatively small amount of money, some lenders consider the risk of not having title insurance coverage for the cost overruns to be an acceptable risk.

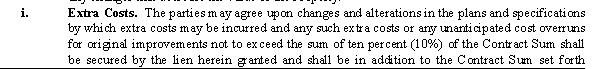

A third option is available only when the amount of the cost overrun is 10% or less of the original contract amount. Section (i) of our standard Residential Construction Contract (shown below) provides that the Residential Construction Contract secures up to 10% of extra costs for unanticipated cost overruns over and above the original contract amount. Thus, without a modification of any sort, our documents create a valid mechanic’s lien for the amount stated on the contract plus up to 10%.