October 20, 2021

OCC LIBOR Transition, Cybersecurity Awareness Month, PPDocs Year-End Holiday Schedule, and more!

Read more below!

OCC LIBOR Transition Updated Self-Assessment Tool for Banks

OCC Bulletin 2021-46, issued October 18, 2021, provides an updated self-assessment tool for banks to evaluate their preparedness for the cessation of the London Interbank Offered Rate (LIBOR). The bulletin rescinds OCC Bulletin 2021-7, “LIBOR Transition: Self-Assessment Tool for Banks,” published on February 10, 2021, and replaces the tool attached to OCC Bulletin 2021-7.

October is Cybersecurity Awareness Month

October represents the 18th annual Cybersecurity Awareness Month designed to raise awareness of urgent cybersecurity issues and provide resources for safer and more secure online experiences. As part of the observation, the Texas Department of Banking released Industry Notice 2021-07. The information in the notice is useful for all financial and nonfinancial entities.

As we said in our August newsletter, we at PPDocs take information security and cybersecurity very seriously. Please see the August newsletter for a summary of the precautions we take. If you have any questions regarding our cybersecurity efforts, please contact us.

PPDocs Year-End Holiday Schedule

To help our clients plan for the upcoming holidays, here is our holiday schedule for the remainder of 2021:

• We will close Thanksgiving Day but open the Friday after Thanksgiving.

• We will close at noon Christmas Eve. (Christmas Day is on Saturday.)

• We are open New Year’s Eve. (New Year’s Day is on Saturday.)

PPDocs Compliance Specialist Participates in BOL Lending Compliance Triage

Next month, PPDocs Compliance Specialist Randy Carey is a scheduled presenter at BOL’s 2-day Lending Compliance Triage. Click here for more information and to register. We thank Bankers Online for this opportunity. We hope you join Randy online on November 2nd and 3rd.

Frequently Asked Question

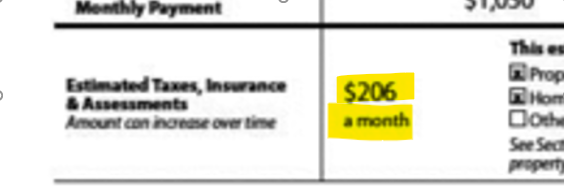

Question: Do we disclose a single pay loan with “Monthly” instead of “Single Pay” in the Estimated Taxes, Insurance & Assessments section of the Loan Estimate?

Answer: To answer this question, we need to review §1026.37(o)(5)(i) of Reg. Z:

(5) Exceptions. (i) Unit-period. Wherever the form or this section uses “monthly” to describe the frequency of any payments or uses “month” to describe the applicable unit-period, the creditor shall substitute the appropriate term to reflect the fact that the transaction's terms provide for other than monthly periodic payments, such as bi-weekly or quarterly payments.

Comment - 4. Unit-period. Section 1026.37(o)(5)(i) provides that wherever form H-24 or § 1026.37 uses “monthly” to describe the frequency of any payments or uses “month” to describe the applicable unit-period, the creditor is required to substitute the appropriate term to reflect the fact that the transaction’s terms provide for other than monthly periodic payments, such as bi-weekly or quarterly payments. For purposes of § 1026.37, the term “unit-period” has the same meaning as in appendix J to Regulation Z.

While the commentary references “unit-period” as defined in Appendix J, §1026.37(o)(5)(i) specifically refers to periodic payments other than monthly. There are no periodic payments on a single advance, single payment transaction. As such, we believe that using the default monthly unit-period is required in the ETIA Table on the Loan Estimate and Closing Disclosure.

As a practical matter, while Appendix J does define the unit-period differently for a single advance, single payment transaction, the application of that definition within the TRID disclosures would be virtually impossible.

Appendix J – (b)(4)(ii) In a single advance, single payment transaction, the unit-period shall be the term of the transaction, but shall not exceed 1 year.

Appendix J – (b)(5)(vi) In a single advance, single payment transaction in which the term is less than a year and is equal to a whole number of months, the number of unit-periods in the term shall be 1, and the number of unit-periods per year shall be 12 divided by the number of months in the term or 365 divided by the number of days in the term.

Appendix J – (b)(5)(vii) In a single advance, single payment transaction in which the term is less than a year and is not equal to a whole number of months, the number of unit-periods in the term shall be 1, and the number of unit-periods per year shall be 365 divided by the number of days in the term.

If, for example, a lender has a single advance, single payment transaction that is 9 months long. That means in the ETIA Table, the lender would calculate the estimated amount of taxes, insurance and assessments due for a 9-month period in order to disclose the payment amount and label the period as nine months.

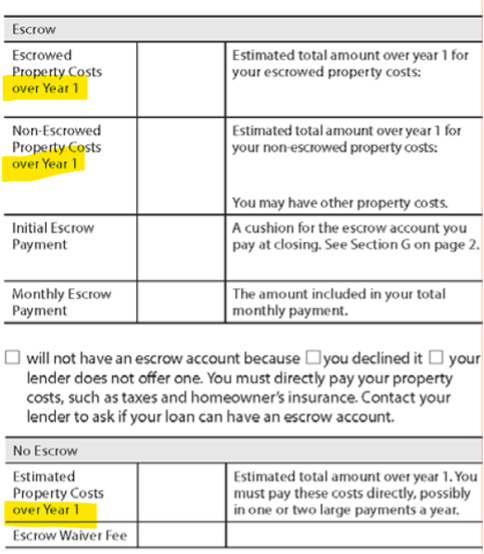

Because it would be highly unlikely for a lender to even attempt to establish an escrow account on such a short-term loan, the lender would be required to divide that amount by 9 and multiply by 12 to populate the “over 1 Year” disclosures in the “No Escrow” account table on Page 4 of the CD.

Further, if a loan had a term of 195 days for a single advance, single payment transaction, the term is not denominated in whole months. That would create a unit-period of 195 days or 6.5 months. Thus, the ETIA table would indicate a payment equal to 195 days’ worth of insurance taxes and assessments and the unit-period as 195 days or 6.5 months. That amount would be divided by 195 and multiplied by 365 to populate the “over Year 1” escrow table on Page 4 of the CD.

Such disclosures would be meaningless to the consumers and very difficult to calculate. We do not believe disclosure in that manner was ever contemplated by the CFPB and we do not believe the wording in the regulation supports that manner of disclosure.